Chamber member and retirement industry leader Fidelity Investments introduced the Fidelity Advantage 401(k)SM pooled employer plan (PEP) for small businesses in 2021 when the SECURE Act first made it possible for unrelated businesses to join together in a single 401(k). Now celebrating two years in market, PEPs are still unfamiliar to some, but they may offer a high-value, low-cost 401(k) alternative to the state-run IRA for Colorado businesses facing upcoming retirement mandate deadlines.

While there are different retirement plan options available, business owners looking to maximize their own and their employees’ ability to save, or competing in a tight labor market, may want to consider a 401(k) plan. With a 401(k), owners and employees can contribute almost 3.5 times more to the plan annually than with a state-run IRA, and contributions can be made pre-tax to lower personal tax liability. Moreover, 401(k) plans allow employers to match contributions. By offering a 401(k) instead of a state-run IRA, small businesses can stand out in a competitive talent marketplace and at the same time level the playing field with larger employers who commonly view a 401(k) with a match as table stakes1. According to a recent Wall Street Journal article, more and more small businesses are offering 401(k) plans in the face of heightened demand for employees. “The creation of new 401(k) plans occurs as competition for workers tightened in recent years, causing some employers to enhance workplace benefits to attract and retain workers.”2

If a 401(k) seems like the right plan type for your business, but you have lingering concerns about cost, administrative requirements, or fiduciary risk, you may want to consider a pooled employer plan (PEP). A PEP is a 401(k) sponsored by a pooled plan provider who takes on most of the fiduciary and administrative burdens. Because multiple employers join one plan, costs are shared and are typically far lower than with a traditional 401(k). The Fidelity Advantage 401(k) PEP allows small businesses to access an affordable, turnkey 401(k) built just for first-time plan providers and backed by a recognized and proven industry leader.

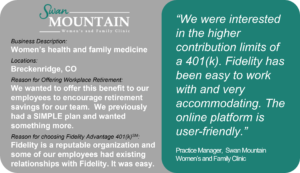

And that is just what Swan Mountain Women’s and Family Clinic in Breckenridge was looking for. Initially told that 401(k) plans were not for small businesses, the practice manager turned to Fidelity because of its strong reputation and existing relationships with some employees. In the Fidelity Advantage 401(k) she found an affordable and easy-to-launch retirement plan that would allow employees to maximize their retirement savings at a low cost to the business.

Determining the best plan option for your business depends on many factors, including your own retirement objectives, your employees’ savings needs, and your business goals. Before choosing a retirement plan, take time to consider the available options, compare costs and plan details, and look for an established and trusted provider.

To learn more about Fidelity Advantage 401(k), visit Fidelity’s website.

To learn more about Colorado SecureSavings, visit the Colorado SecureSavings website.