In this Capitol Report:

- Two Competing Transportation Funding Proposals Qualify for November Ballot

- Colorado Manufacturers Tour Primus Aerospace

- EPA Proposes Replacement of Obama-Era Clean Power Plan

- MyBiz.Colorado.gov Website Simplifies Launching New Colorado Businesses

- Department of Revenue to Propose Rule on Sourcing of Retail Sales

- Colorado’s 2018 Political Playoffs

- Join the Colorado Chamber at our End of Summer Happy Hour…

Two Competing Transportation Funding Proposals Qualify for November Ballot

Within two back-to-back days this week, two competing transportation-funding initiatives qualified for the November ballot.

In brief, Colorado voters will be asked whether they want (a) more money to go to transportation from the state’s General Fund budget or whether they want (b) to use new revenue from a tax increase to pay for transportation improvements.

- Initiative 167 would authorize up to $3.5 billion in transportation bonds that would have to be repaid by the legislature from the General Fund budget. The proposal would not increase taxes.

- Initiative 153 would increase the state sales tax for 20 years by 0.62 percent to 3.52 percent. The revenue would be used to repay up to $6 billion in bonds to be used for state roads, local transportation needs and multi-model transportation projects.

Initiative 167

On Wednesday, the Colorado Secretary of State’s Office announced that Initiative 167 will be on the November ballot.

The Statistics of Counting Signatures

Supporters of Initiative 167 submitted 169,568 signatures. To qualify for the ballot, an initiative needs 98,492 signatures. The Secretary of State’s Office does not, however, review all signatures that are submitted.

Instead, the Office reviews a 5 percent random sample to project the number of valid signatures needed to exceed 110 percent of the 98,492.

In the case of Initiative 167, the Office reviewed 8,479 signatures. Of this total, 5,644 were found to be valid, which then projects that 112,872 signatures would be valid of the total number submitted.

In other words, the total projected percentage of valid signatures is 114.6 percent, which exceeds the minimum required 110 percent by 4.6 percent.

Initiative 167: Authorize Bonds for Transportation Projects

Initiative 167, called “Fix Our Damn Roads,” has been put forth by Jon Caldara, the well-known chief of the conservative think tank, The Independence Institute. The Institute is often labeled “free market” or “libertarian” by the mainstream news media.

The measure would require that the legislature pay from current revenue the debt service on $3.5 billion in transportation bond sales.

Initiative 167 would require the legislature to first make debt-service payments before allocating General Fund revenue to such other programs as P-12 and higher education, corrections and social services, including Medicaid, which the Democratic-controlled legislature expanded in January 2014 under the Federal Affordable Care Act.

The proceeds from the sale of the bonds would be spent only on road-and-bridge expansion, maintenance, construction and repair for 66 specific projects–called Tier 1–located in each of the state’s 15 transportation planning regions.

Under Initiative 167, no money would go to local governments or for multi-modal purposes. No money would be spent on mass transit.

In brief, State spending on other governmental services over twenty years would be reduced by $5.2 billion through fiscal year 2038-2039 because the money would be directed to paying off the bonds.

In backing Initiative 167, many Republicans argue that the legislature should find room in the General Fund budget to pay for transportation infrastructure and are opposed to a tax increase. Colorado Springs Mayor John Suthers, the former Republican Colorado Attorney General, has endorsed the proposal.

Meanwhile, Democrats are concerned that, during the next recession, the legislature would be forced to make deep cuts in education, corrections and social-service programs because the $350 million would first have to be paid each year to service the bond debt. A state that defaults on bond payments faces the drastic prospect that its credit rating could be drastically downgraded, which would raise borrowing costs.

As of August 1st, the Independence Institute had contributed most of the almost $300,000 that had been received by the issue committee, Fix Our Damn Roads, whose identification number is 20175031966 as assigned by the Colorado Secretary of State’s Office.

The Legislative Council’s Initial Fiscal Impact Statement summarizes the proposal:

Summary of Measure

The measure requires the executive director of the Colorado Department of Transportation (CDOT) to issue Transportation Revenue Anticipation Notes (TRANs) no later than July 1, 2019, in a maximum amount of $3.5 billion with a maximum repayment cost of $5.2 billion over 20 years.

Voter-approved proceeds from TRANs are TABOR-exempt and must be used exclusively for road and bridge expansion, construction, maintenance, and repair on the 66 projects identified in the measure, which include projects in each of the state’s 15 transportation planning regions. Transit projects are excluded from the list.

The measure requires the principal and interest on the borrowed money to be paid without raising taxes or fees. The state must reserve the right to repay the TRANs ahead of schedule without penalty.

Initiative 153

Yesterday, the Colorado Secretary of State’s Office announced that Initiative 153 had qualified for the ballot. Advocates had submitted 195,499 signatures. The statistical projection was that 118,259 signatures would be valid, which is 120.07 percent of the required number of valid signatures.

The Colorado Contractors Association and the Metro Denver Chamber of Commerce are leading a statewide coalition of civic and business organizations to advance Initiative 153, whose campaign is called “Let’s Go, Colorado.” Supporting Let’s Go, Colorado is an issue committee, Coloradans for Coloradans, which had raised $2 million as of August 1st. The Secretary of State’s identification number for the committee is 20185033931.

Here’s how the Legislative Council’s Initial Fiscal Impact Statement describes the measure:

Summary of Measure

This measure increases the state sales and use tax rate from 2.9 percent to 3.52 percent between January 1, 2019 and January 1, 2039. In addition, the measure allows the Colorado Department of Transportation to issue bonds totaling up to $6.0 billion. The total repayment cost may not exceed $9.4 billion over 20 years. The revenue generated from the tax increase is dedicated for the following purposes:

- 45 percent for bond repayment and state transportation funding;

- 15 percent for multimodal transportation; and

- 40 percent for municipal and county transportation projects.

The measure also creates a citizen oversight commission that must annually report how the bond proceeds have been used.

More Information and News Media Coverage

For more information on the two transportation-finance ballot proposals, contact Loren Furman, CACI Senior Vice President, State and Federal Relations, at 303.866.9642.

For news media coverage and additional information, read:

“Denver Chamber-backed transportation measure makes fall ballot,” Colorado Politics, August 23rd.

“Fix Our Damn Roads’ transportation initiative qualifies for the Colorado ballot,” by Ben Botkin, The Denver Post, August 22nd.

“Fix Our Damn Roads: No-new-taxes plan makes the Colorado ballot,” by Joey Bunch, Colorado Politics, August 22nd.

“Elections Matter: Legislative and Governor’s Races Plus Potential Critical Ballot Measures Face Business Community,” Colorado Capitol Report, August 10th.

Colorado Manufacturers Tour Primus Aerospace

Randy Brodsky, president of Primus Aerospace with Doug Barr of Hunter Douglas and Kreg Brown of EKSH at a recent MLG quarterly meeting.

Randy Brodsky, president of Primus Aerospace hosted the Chamber’s Manufacturers Leadership Group (MLG) on August 15 for its quarterly roundtable discussion and tour of a Colorado manufacturing facility. Chamber members representing the manufacturing industry were joined by a representative from Senator Michael Bennet’s office, and the agenda included an overview of Primus followed by an opportunity to discuss best practices for addressing industry challenges, and a tour of the facility.

Primus Aerospace provides high-precision, high-complexity machined components, kits and subassemblies for the aerospace, defense and space industries and serves customers across the globe with diversified and complex machined products, assembly services and engineering support, including machining, assembly, testing, design support, welding, grinding and finishing.

EPA Proposes Replacement of Obama-Era Clean Power Plan

During a very busy news cycle this week, the Environmental Protection Agency (EPA) quietly issued a proposal to replace the Supreme Court-blocked Clean Power Plan (CPP) with the Affordable Clean Energy (ACE) Plan – a proposal ‘to reduce greenhouse gas (GHG) emissions from existing coal-fired electric utility generating units and power plants across the country.’

In the EPA’s news release, the ACE plan is described as empowering states and energy independence, while taking advice, expertise and recommendations from more than 270,000 public comments during the December 2017 Advanced Notice of Proposed Rulemaking (ANPRM) to replace the Obama-era CPP. Along those lines, ACE will be subject to a 60-day comment period before it can be implemented and maintains the CPP’s “endangerment finding” that GHGs are a danger to public health and welfare. The proposed rule would likely affect more than 300 power plants across the U.S. and provide incentives to keep coal plants running as-is, rather than retrofitting with natural gas or renewable energy.

“The ACE Rule would restore the rule of law and empower states to reduce greenhouse gas emissions and provide modern, reliable, and affordable energy for all Americans. Today’s proposal provides the states and regulated community the certainty they need to continue environmental progress while fulfilling President Trump’s goal of energy dominance.” — EPA Acting Administrator Andrew Wheeler

For More Details:

The new ACE proposal would reduce CO2 emissions through four key actions:

“1. ACE defines the “best system of emission reduction” (BSER) for existing power plants as on-site, heat-rate efficiency improvements;

2. ACE provides states with a list of “candidate technologies” that can be used to establish standards of performance and be incorporated into their state plans;

3. ACE updates the New Source Review (NSR) permitting program to further encourage efficiency improvements at existing power plants; and

4. ACE aligns regulations under CAA section 111(d) to give states adequate time and flexibility to develop their state plans.”

According to the EPA, the ‘regulatory impact analysis (RIA) for this proposal includes a variety of scenarios. These scenarios are illustrative because the statute gives states the flexibility needed to consider unit-specific factors – including a particular unit’s remaining useful life – when it comes to standards of performance. Key findings include the following:

- EPA projects that replacing the CPP with the proposal could provide $400 million in annual net benefits.

- The ACE Rule would reduce the compliance burden by up to $400 million per year when compared to CPP.

- All four scenarios find that the proposal will reduce CO2 emissions from their current level.

- EPA estimates that the ACE Rule could reduce 2030 CO2 emissions by up to 1.5% from projected levels without the CPP – the equivalent of taking 5.3 million cars off the road. Further, these illustrative scenarios suggest that when states have fully implemented the proposal, U.S. power sector CO2 emissions could be 33% to 34% below 2005 levels, higher than the projected CO2 emissions reductions from the CPP.’

To critics who say the proposed ACE rule would lead to significant human health concerns and collateral damage compared to what a fully-implemented CPP would have done, the EPA’s Air Chief William Wehrum says, “We have abundant legal authority to deal with those other pollutants directly, and we have aggressive programs in place that directly target emissions of those pollutants.”

What’s Being Said In The News:

EPA Proposes Affordable Clean Energy (ACE) Rule, EPA.gov

Trump Moves to Let States Regulate Coal Plant Emissions, NPR

Cost of New EPA Coal Rules: Up to 1,400 More Deaths a Year, New York Times

Climate Fight Can’t Be Slowed, Even By The EPA, Bloomberg (editorial)

MyBiz.Colorado.gov Website Simplifies Launching New Colorado Businesses

Looking to start a new Colorado business? The state of Colorado has launched a new website to make that process much easier.

MyBiz.Colorado.gov was developed jointly by the Governor’s office and the Secretary of State. The project engaged more than a half dozen state agencies working together to provide new businesses a better way to meet many state requirements.

The project began because of Governor John Hickenlooper and Secretary of State Wayne William’s shared goal for Colorado to offer the best possible service for the business community. It’s this approach that gives Colorado its well‐deserved “business friendly” reputation and encourages so many new businesses to become part of our state.

MyBiz.Colorado.gov provides a single system to interact with multiple state agencies responsible for new businesses, including the Secretary of State’s Office, Department of Revenue, Department of Labor and Employment, and Office of Economic Development and International Trade.

The new site is accessible and intuitive, and efficiently helps businesses register with state agencies and obtain necessary licenses and permits. Users will find a resource library and tutorials to help plan and develop new businesses. There are numerous prompts along the way for help and to contact the right person who can answer questions. The site is also available in Spanish.

With MyBizColorado.gov, you’ll find what you need in one place—instead of having to go to individual websites for the departments of Labor and Employment, Revenue, and others. The site will be especially helpful for small businesses that don’t have the resources or staff of big corporations.

If you’re starting a business, take a look at MyBiz.Colorado.gov. The site was unveiled in early June and already thousands of business registrations and licenses have been issued to users of the system.

Department of Revenue to Propose Rule on Sourcing of Retail Sales

The Department of Revenue Division of Taxation held a stakeholder work group on December 5, 2017 to discuss a potential rule on sourcing retail sales in Colorado to determine which jurisdictions may impose tax on the sale. As a result of that work group, the Department is soliciting public comments on a draft rule dealing with the sourcing of retail sales and other rules conforming to the proposed sourcing rule. If you wish to provide comments on these rules, you may do so by reviewing the draft rules and submitting comments to [email protected] by Friday, September 7, 2018.

Depending on the comments the Department receives, the Department plans to hold a rulemaking hearing on these rules later this year. Additional comments will be accepted until the rulemaking hearing is complete.

Please contact Loren Furman at [email protected] or 303-866-9642 if you should have any questions regarding this matter.

Colorado’s 2018 Political Playoffs

Sponsorships now available for Colorado Chamber of Commerce Annual Meeting Luncheon. Click here for sponsorship opportunities. Do not miss the opportunity to connect with business leader’s from across the state on Thursday, October 25th.

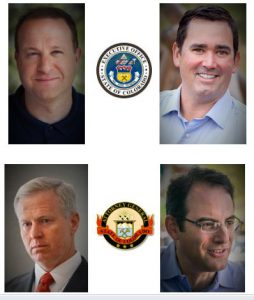

Governor

Polis (D) and Stapleton (R)

Attorney General

Brauchler (R) and Weiser (D)

Join the Colorado Chamber at our End of Summer Happy Hour…

Date: Monday, August 27th

Time: 4:30-6:30 p.m.

Location: Cherry Cricket Ball Park- 2220 Blake Street, Denver, CO 80205

Thanks to our Sponsors: