In this Capitol Report:

This Capitol Report is brought to you by:

State Policy News

Anti-Business Bills Go Down In Flames in GOP-Controlled Senate

In a critical election year, it is no surprise that business is the target of many bills in the Colorado General Assembly offered up by liberal Democrats in the Senate and the House.

In the Republican-controlled Senate, the bills meet a quick fate, expiring in committee, which is often the Senate majority leadership’s “kill committee,” the Senate State Veterans and Military Affairs Committee.

Meanwhile, in the Democrat-controlled House, bad-for-business bills usually make it all the way through the committee process and Second and Third Reading on the chamber’s floor and are then sent to the Senate, where they die, often in the Senate State Affairs Committee, as it’s popularly known.

Conversely, the same process also happens to the GOP’s pro-business bills. The House GOP bills die in committee, usually the House State, Veterans and Military Affairs Committee. And the GOP bills that come over from the Senate also die, often in the House State Affairs Committee, the House majority leadership’s “kill committee.”

Ed Sealover, veteran statehouse reporter for The Denver Business Journal, interviewed Loren Furman, CACI Senior Vice President, State and Federal Relations, about the fate of the anti-business bills:

Loren Furman, senior vice president of state and federal relations for the Colorado Association of Commerce and Industry, said the measures, which almost solely have been Democrat-sponsored, were expected in an election year where both parties sometimes view making statements with voters as more important than passing bills.

She credited members of the Republican-run Senate State, Veterans and Military Affairs Committee, which has heard and killed many of the bills, for understanding the needs of companies, despite accusations that the committee is ignoring the needs of workers.

“They clearly understand that mandates don’t work on businesses,” Furman said. “The state shouldn’t be telling private-sector employers how to run their businesses.”

Bills that have already died would have:

- Required all companies to allow workers to accrue paid sick leave;

- Required restaurants that don’t offer paid sick leave to post signs noting their policies;

- Allowed local governments to raise minimum wages above the state level;

- Restarted a commission to look into pay-equity issues at workplaces;

- And overturned cities’ laws that ban the homeless from sleeping certain places.

Furman said she expects further messaging bills involving subjects like worker access to personnel files and punishments for wage theft to be coming.

CACI’s legislative lobbying agenda, updated every two weeks for the meeting of CACI’s Governmental Affairs Council, provides an overview of the bills that CACI is lobbying.

Because legislation can move quickly, CACI members should visit the legislature’s Web site to determine where a bill is at any time and whether or not the bill has been amended.

For information on the bills that CACI is lobbying, contact Loren at 303.866.9642.

For more information on business bills in the legislature this session, read:

“Colorado GOP lawmakers are batting down business-unfriendly bills,” by Ed Sealover, The Denver Business Journal, March 4th.

“Colorado business leaders differ on top priorities for this legislative session,” by Ed Sealover, The Denver Business Journal, March 3rd.

HB-1275: “Black List” Countries, then Make Colorado Corporations Prove Their “Innocence”

This morning, the Democrat-majority House Appropriations Committee passed CACI-opposed HB-1275 on a party-line, 7-6 vote, which sends the bill to the House Floor for Second Reading debate.

The fast-tracked HB-1275 would empower the Colorado Department of Revenue (DOR) to “black list” countries that it alleges are “tax havens.” Colorado corporations with subsidiaries or affiliates operating in these countries would then have to prove to the DOR that their operations are legitimate business activities and not attempts to shelter income from the Colorado corporate income tax.

Second reading on the bill could come early next week, depending on the decision by House Speaker Dickey Lee Hullinghorst (D-Boulder), who strongly voiced the support of the House Democratic Caucus for such legislation in her session opening-day speech. A similar bill died in the 2015 session.

The CACI Tax Council provided the Committee members with arguments that refuted in detail the bill’s fiscal note, which assumes that an estimated $75 million in corporate income-tax revenue would flow to the DOR over three years.

CACI members with questions about HB-1275 should contact Loren Furman, CACI Senior Vice President, State and Federal Relations, at 303.866.9642.

For more information on HB-1275, read:

“House Finance Committee OKs Tax Haven Bill,” CACI Colorado Capitol Report, February 25th.

Two New Developments on the Hospital-Provider Fee Front

On Monday, Colorado Attorney General Cynthia Coffman (R) issued her legal opinion that the legislature could constitutionally craft a state enterprise for the hospital-provider fee (HPF).

Converting the HPF into a state enterprise would free up hundreds of millions of dollars for transportation, education and State Government capital construction.

CACI supports the conversion. More than 100 businesses, business organizations, higher-educational institutions, hospitals, non-profit organizations, K-12 entities, medical organizations and others have endorsed the HPF conversion.

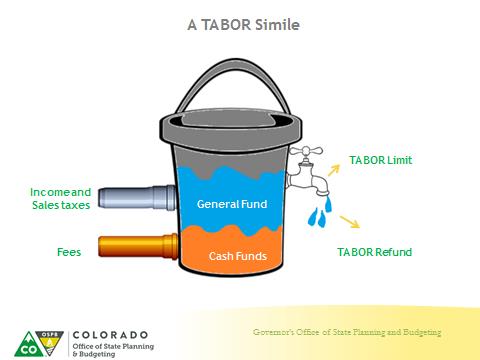

Under TABOR, a state enterprise is defined as “. . . a government-owned business authorized to issue its own revenue bonds and receiving under 10 percent of annual revenue in grants from all Colorado state and local governments combined.”

The following day, House Speaker Dickey Lee Hullinghorst (D-Boulder) announced that she would soon introduce a bill to do just that. An effort to convert the HPF at the end of the 2015 session died in the Senate. Governor John Hickenlooper (D) strongly supports the conversion as well.

Senate President Bill Cadman (R-Colorado Springs) remained opposed, however, to the proposal despite the opinion from Attorney General Coffman. According to The Denver Business Journal, Senate President Cadman “went as far as to say Tuesday that any bill from (Speaker Hullinghorst) is dead on arrival if it . . . does not reset the Taxpayer’s Bill of Rights revenue cap by pulling the current provider-fee revenues out of the calculations and lowering that cap in future years.”

The HPF fee, enacted in 2009 when the Democrats controlled both legislative chambers, is generally matched by Federal funds to create more than $1 billion that goes back to the hospitals to support Medicaid patients–including the expansion of Medicaid under the Federal Affordable Care Act approved by the legislature when it was controlled by the Democrats–and uncompensated care.

The HPF is counted under the TABOR cap, however, and is projected in the next fiscal year beginning July 1st to boost the revenue total above the TABOR cap, which will then mandate TABOR rebates to the taxpayers. Excising the HPF from under TABOR would lower the revenue total, which would mean that there would not be any TABOR refunds.

To more easily understand this complex issue, see the graphic that shows how fees (think of this as water) that flow into the bottom of the revenue bucket under TABOR boosts the next layer of fluid (think of it as oil) that is sales and income tax revenue. When the fluid goes above the level of the faucet (the TABOR limit), then dollars flow out as TABOR refunds.

Senator Cadman told The Denver Business Journal that “ . . . he still finds one portion of Hullinghorst’s 2015 provider-fee bill to be unconstitutional. That portion states specifically that removing the provider-fee revenues from the overall base of tax revenues that determine when the state has exceeded the TABOR cap will not reduce the base on which the cap is determined — a derivation from past efforts to take money out of the general fund and put it into an enterprise fund.”

In early January, Colorado Senate President Bill Cadman (R-Colorado Springs) released a memo from the legislature’s Office of Legislative Legal Services about the constitutionality of converting the hospital provider fee to a state enterprise. The memo, which was dated December 31, 2015, concluded that the HPF could not be converted to a state enterprise:

Because the entity would not satisfy the requirement of being a government–owned business, it would not qualify as a TABOR-exempt enterprise, and HPF revenue it collected would be included in state fiscal year spending and counted against both state fiscal year spending limits.

CACI members with questions about the HPF conversion issue should contact Loren Furman, CACI Senior Vice President, State and Federal Relations, at 303.866.9642.

For more on this topic, read:

“Republican leader: TABOR issue rides on who should decide,” by Joey Bunch, The Denver Post, March 4th.

“Hullinghorst to introduce Colorado hospital-provider fee despite continued GOP opposition,” by Ed Sealover, The Denver Business Journal, March 3rd.

“Colorado AG gives OK to controversial hospital provider fee move,” by John Frank, The Denver Post, February 29th.

“Colorado AG: hospital provider fee OK as an enterprise fund; change could help with road funding,” by Ed Sealover, The Denver Business Journal, February 29th.

“Two Former Gubernatorial Legal Counsels Issue Bipartisan Legal Opinion about Hospital Provider Fee,” CACI Colorado Capitol Report, February 12th.

“Colorado Business Day Luncheon: Budget Issues, Transportation Funding, Construction-Defect Reform Dominate Legislative Leaders’ Discussion,” CACI Colorado Capitol Report, January 22nd.

“Colorado Business Organizations: Revise Hospital Provider Fee to Fund Roads and Bridges,” CACI Colorado Capitol Report, December 18, 2015.